Marco Marinelli

8 mrt. 2023

How Eigenlayer enables infrastructure-level innovation on Ethereum by leveraging the existing trust network through ETH re-staking

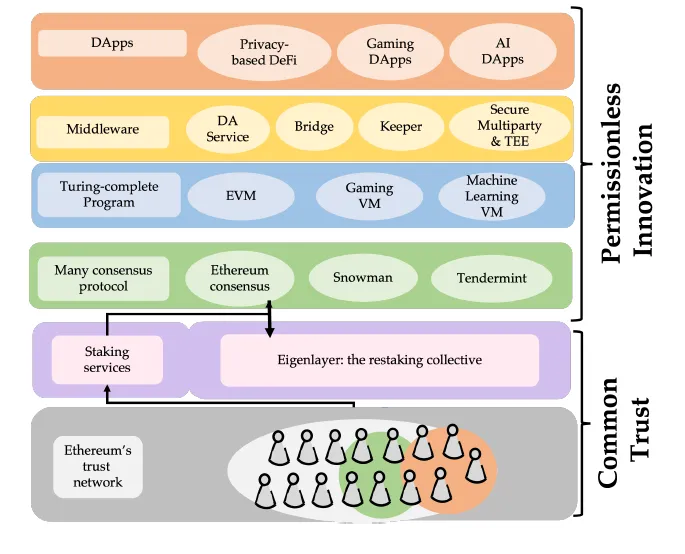

In 2009, Satoshi Nakamoto introduced the first permissionless blockchain network to the world: Bitcoin. Despite its security coming from the Proof-of-Work (PoW) algorithm, the chain lacked programmability. To address this shortcoming, Vitalik Buterin and his team launched Ethereum in 2013, offering the first platform for decentralized applications (dApps) enabled by Turing complete smart contracts. Ethereum expanded programmability at the application level.

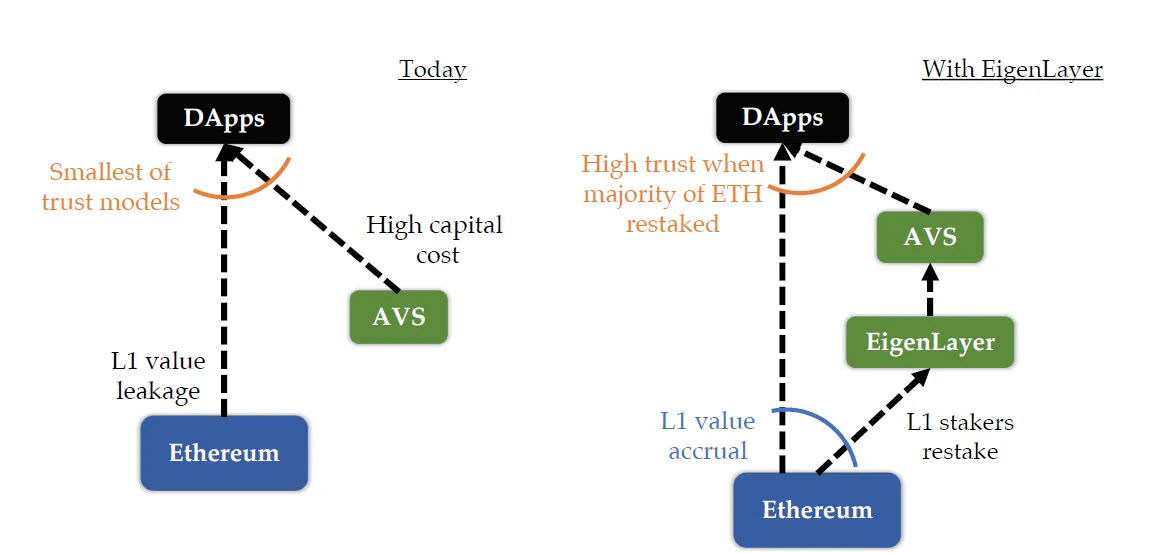

However, Ethereum still faced limitations in terms of infrastructure-level innovation. Upgrades at a deeper level of the stack required the creation of a new blockchain network and, consequently, a new trust network*, which fragmented security across different blockchains. This limitation still persists today.

Eigenlayer is a new Ethereum-based project seeking to drastically reduce the friction faced by developers at the infrastructure level. By leveraging the established trust network of the Ethereum Mainnet, Eigenlayer aims to supercharge infrastructure-level innovation through the process of re-staking ETH. This article provides a short technical overview of the matter. *The term “trust network” refers to the network of nodes that validate transactions and produce blocks in a blockchain and other Distributed Ledger Technologies. For instance, miners running the Bitcoin PoW algorithm make up Bitcoin’s trust network (i.e. trust layer), which is the component that makes DLTs resilient to tampering and censorship.

What is Eigenlayer?

At its core, Eigenlayer is essentially a set of smart contracts deployed on the Ethereum Mainnet. In practice, Eigenlayer functions as a marketplace for decentralized trust, where Ethereum stakers and other services that are seeking to leverage a pooled security model meet.

On the demand side of the market, there are all those services looking to bootstrap a trust network. On the supply side, we find Ethereum stakers that have decided to opt-in to Eigelayer to provide additional security and validation services through the ETH re-staking process.

Today, when an Ethereum validator node operator decides to join a new PoS network, he must invest significantly in acquiring enough coins to collateralize his operations. Additionally, this operator must also attract coin holders to stake with it. This is both costly and challenging to accomplish. With the advent of Eigenlayer, ETH stakers may opt-in to join a new network using their already-staked ETH as collateral for the new operation.

The third-party PoS networks mentioned above are referred to as Actively Validated Services (AVSs). For instance, an AVS could be an off-chain service on which Ethereum dApps depends, like a decentralized oracle network or a cross-chain bridge.

In the Ethereum network, validators earn a variable yield on their staked ETH based on the blocks produced and network activity. The stake can always be withdrawn (from the Shanghai update onwards), provided the node behaves honestly. However, if the validator provably misbehaves, the Ethereum protocol will actuate a slashing mechanism. Slashing a validator’s stake will result in a financial loss, allowing PoS networks to incentivize good behavior while disincentivizing misconduct.

Similarly, on Eigenlayer, as long as the re-staking nodes behave honestly on the new network, their staking yield will be greater than without restaking. This happens because the staked amount remains locked, and the revenue of servicing two networks is expectedly greater than only one. Nevertheless, if the validator acts maliciously, the slashing mechanism will be triggered (i.e. its stake is either partially or entirely removed). When the bad actor is a re-staker, getting slashed means it loses access to the original ETH staked to secure the Ethereum Mainnet. The ability to opt-in and accept the risk of potentially getting slashed is often called “programmable slashing.”

How re-staking works?

Re-staking can occur in four distinct ways:

Liquid re-staking

Native re-staking

ETH-LP re-staking

LSD-LP re-staking

Liquid re-staking involves locking Liquid Staking Derivatives (LSDs) in Eigenlayer's Ethereum Mainnet smart contracts. An LSD can be issued by entities such as Lido and Rocketpool and is an ERC-20 token representing an ETH staking position. Those positions could be called “receipt tokens” since they are issued as proof of ownership of an ETH deposit (stake). With LSDs, ETH stakers can support the network's security while concurrently employing their locked capital elsewhere, thereby enhancing liquidity in the DeFi space and elevating capital efficiency. Staking assets such as Lido's stETH on Eigenlayer empowers the Eigenlayer smart contracts to take control over the staked fund if the staker fails to comply with the new network's unique “rule set” and/or misbehaves.

In the case of native re-staking, there is no involvement of LSD providers. Instead, a node operator who opts in to join a new network will provide the Eigenlayer’s smart contracts with the keys to withdraw his ETH stake (the withdrawal credentials). If the staker provably misbehaves, the Eigenlayer’s smart contracts will withdraw the ETH on the re-staker’s behalf and either burn or redistribute as punishment for their misconduct. The exact amount of Ether deducted depends on how severe their misbehavior was and what type of penalty is imposed upon them by the network rules.

The two remaining methods of restaking are more exotic and leverage the relatively novel concept of superfluid staking, or in the present context, superfluid re-staking. Superfluid staking enables the liquidity providers of Decentralized Exchanges (DEXs) to stake Liquidity Provision tokens with validator nodes. In this way, liquidity providers can concurrently participate in securing the network, thus earning a greater yield.

Generally, a Liquidity Provision token (LP) is issued to DEX users after joining a liquidity pool. Akin to LSDs, LP tokens represent a claim to a position, meaning only the holder of an LP token can withdraw the underlying tokens from the pool. Similarly, Eigenlayer’s smart contracts allow validator nodes to re-stake certain ETH-LP tokens (i.e. LPs that include ETH).

Lastly, LP tokens that contain Ethereum LSDs (e.g. Curve Finance’s stETH-ETH LP token) can also be re-staked on Eigenlayer.

Programmable slashing

The previous paragraphs considered the slashing process and its implications almost trivial. However, it is one of the most important components of the Eigenlayer stack. Slashing deserves careful attention since malfunctioning might harm both the Eigenlayer and Ethereum network. Assumed that smart contracts are immutable and blockchains are highly deterministic, running the code within a contract should always result in the same expected outcome. Therefore, if an Eigenlayer contract slashes someone, then it must mean that the re-staker did not comply with the given rule set. Yet, is this seemingly logical assumption always verified? The truth is, not entirely.

The issue is that a smart contract may have an unnoticed bug that could cause an unjustified slashing – or even multiple ones. An attacker may also discover an attack vector and consequently succeed in slashing re-stakers for some arbitrary reason. Both scenarios could leave the network in question in a very unsafe predicament.

Slashing small amounts of ETH will likely have a negligible short-term negative impact. However, if enough ETH is slashed, it means the presence of significantly fewer stakers and therefore a considerable decrease in the total stake. In this unfortunate scenario, Ethereum would find itself much more centralized and cheaper to attack.

The need for a human subjectivity layer

To avoid unwanted slashings, Eigenlayer has chosen to employ a human subjectivity layer in the form of a small committee with the power to veto slashing events. The committee is tasked with ensuring that only provable misbehavior can trigger a slashing. On an important note, the committee will have no power to actuate a slashing, only veto or approve.Given the sensitivity of the topic, there will naturally be disagreements fueled by differing ideological beliefs within the Ethereum-Eigenlayer community regarding the composition of the committee. Regardless, the team recently made clear that the veto committee will be reputation-based and made up of highly knowledgeable and reputable members of both Ethereum and Eigenlayer’s communities, such as core Ethereum developers and Eigenlayer team members.

It must be noted that subjectivity is usually what one aims to eradicate in Web3 since it enlarges the trust assumptions participants must make. In the particular case of Eigenlayer’s veto committee, AVSs and restakers must trust that the committee will veto any incorrect slashing and not veto any correct slashings.

Like the core Eigenlayer protocol itself, the veto committee is opt-in, meaning it will serve as a fallback mechanism while the AVSs codebase is battle-tested over time. As audits will be performed and potential bugs discovered, the AVS may stop relying on the veto committee to guarantee that its validator set is not at risk of illegitimate slashings. In the whitepaper, this mechanism is compared to having training wheels on a bike, where Eigenlayer will provide an extra layer of protection while these AVSs mature. This way, if something goes wrong during testing, it will not have any major repercussions since this line of defense will prevent unintended slashing from occurring.

Governance

The committee will also handle governance-related matters regarding the Eigenlayer protocol. These include approving upgrades to Eigenlayer’s smart contracts and accepting new AVSs into the slashing review process. Specifically, security audits must also be conducted before onboarding any new AVS onto Eigenlayer to identify and address potential vulnerabilities.

Advantages of Eigenlayer

The introductory paragraphs of this article dialed the clock back a few years to explain how Ethereum expanded the programmability of Bitcoin at the application level, allowing anyone to deploy a dApp without having to develop an entirely new blockchain network. This contributed to the creation of DeFi, a low-friction space for innovation at the application level led by the private sector.

The main advantage that Eigenlayer brings to the Ethereum ecosystem – and Web3 in general – is precisely the ability to reduce the existing frictions that slow down innovation at a deeper level of the stack. This is one of the team’s main goals, facilitating and accelerating the development and adoption of Web3.

In the crypto space, we have often seen how a single innovation can be the enabler of many others. Eigenlayer might belong to this set.

For instance, derivatives trading protocols require high throughput and low gas fees, so they would never work on Ethereum layer-1. Layer-2s (and alternative Layer-1s) made these protocols viable by reducing the gas fees in their modular execution layers. As a result, the derivatives trading sector is now growing and evolving at a lightning-fast rate. Similarly, Eigenlayer aims to enable a larger volume of Web3 infrastructure protocols to be developed quicker. These infrastructure-level innovations could be applied to areas such as decentralized storage, decentralized cloud, oracles, data availability, and many more.

Another advantage this novel solution provides concerns the cryptoeconomic security of the Ethereum ecosystem and the deleveraging of ETH.

Cryptoeconomic security provides a layer of defense against malicious actors by making it more difficult to attack a certain system due to the associated costs. In other words, attackers must risk a certain amount of money in advance, regardless of the attack outcome. This is often referred to as the Cost-of-Corruption (CoC). When this figure is smaller than the potential Profit-from-Corruption (PfC), there is a higher chance of an attack occurring.

In PoS blockchains, the network’s security is determined by the Total Value Staked (TVS). Presently, around $400B of market cap in the Ethereum ecosystem is secured by a meager $15.6B (the USD value of the total ETH staked). Dividing the former by the latter will output the leverage of ETH’s security; roughly 25 times.

Note that this is simply the ratio of the value secured by the Ethereum protocol and the value of the total ETH staked. Though high, this figure is highly influenced by Ethereum’s current development roadmap.

As more applications are deployed on Ethereum, the leverage figure rises, indicating that the potential value an attacker could extract increases as network security does not improve proportionally. However, in the long term, the system adjusts itself by elevating the value of ETH due to increased demand driven by the opportunity to earn staking yield by staking ETH. Naturally, the staking yield also rises as network activity increases because a node's rewards comprise a portion of the gas fees paid in a block.

Interestingly, dApps in the Ethereum Ecosystem depend not solely on the $15.6B staked today. As a matter of fact, they are significantly dependent on middleware such as cross-chain bridges and oracles. An example of middleware could be a data availability layer with more significant trust assumptions. Consequently, the cost of attacking a dApp is the cost of attacking the weakest service on which the dApp relies.

If oracles and other infrastructure components use Eigenlayer to attract re-stakers and “borrow” Ethereum’s trust network, the whole ecosystem will become more secure. This happens because the difference between the cost to attack the weakest link and the total value of ETH staked is expected to be lower, according to the Eigenlayer team.

Furthermore, in the ideal scenario where all Ethereum nodes secure all the middleware servicing dApps, the Ethereum dApp Ecosystem would genuinely enjoy a Pooled Security model. In this case, the difference between the cost to attack the weakest link and the Ethereum TVS is null since all the services dApps depend on are as secure as the Ethereum protocol.

The Eigenlayer team makes a valid point claiming that re-staking the TVS of Ethereum will grow over time for two main reasons. The first reason is that higher yields will increase participation, lifting TVS. The second reason speculates that since the yield that 1 ETH can generate will rise, so will the demand for the asset. Also, note that the opportunity to earn a yield on ETH improves as more protocols build on Eigenlayer. According to the team, this will make the value of ETH rise, and the TVS will consequently follow.

Programmable decentralization

It is a known fact that decentralization is one of the core values of Web3. However, there is a clear tendency for the decentralization properties of distributed systems to erode to some extent over time. For instance, individual stakers who delegate their holdings to trusted validators appear to follow a pattern of choosing the nodes with the most stake. Although such behavior is counterproductive since it hurts decentralization, it is understandable as this indicates that others trust the operator.

As described earlier, Eigenlayer enables programmable slashing to enforce restakers’ positive behavior. Yet, it is not the only realm where programmability is being expanded. In fact, AVSs can specify the criteria ETH validators must meet to provide their services.

Naturally, not all AVSs will value decentralization the same way. Those that value this property the most might choose, for instance, to limit participation to Ethereum “home stakers”. The term refers to smaller-sized node operations run by individuals without affiliation to other operators. Limiting participation to home stakers would expectedly help the AVS to reach more satisfactory levels of decentralization due to its highly heterogenous validator set.

Multi-token quorums

As explained, novel PoS networks must issue their own coin, which can be staked by validator nodes in order to secure the network. With the advent of Eigenlayer, this practice may become a relic of the past. Although not an outrageous idea, this is unlikely, even when ETH restaking via Eigenlayer becomes standard practice.

With Eigenlayer, AVSs can issue their coin ($AVScoin) and give it utility similar to a typical native asset (e.g. staking, value accrual, gas token, governance, etc.). This choice does not exclude ETH restakers from providing their services, thanks to a mechanism called Multi-Token Quorum. A multi-token quorum is a type of consensus mechanism that requires multiple tokens to be staked for an action or transaction to occur. Due to this mechanism, developers have maximum flexibility in specifying the utility of $AVScoin, leading to a wide range of Multi-Token Quorum configurations.

AVSs can issue their own coin (e.g. $AVScoin) which can be utilized similarly to a typical native asset (e.g. staking, value accrual, gas token, governance, etc.). Thanks to the Multi-Token Quorum mechanism, this option does not preclude ETH restakers from offering their services. This mechanism necessitates the staking of multiple tokens for an action or transaction to take place. Due to this mechanism, developers have significant flexibility in defining the utility of $AVScoin, resulting in various Multi-Token Quorum configurations.

Having two distinct sets of validator nodes (ETH restakers and $AVScoin stakers) introduces many interesting possibilities for developers to explore. Moreover, it can have significant security benefits because the market value of the $AVScoin becomes a lesser factor influencing the cryptoeconomic security of the AVS. If its value drops significantly, the network's security will logically drop. However, even at a $0 price, the ETH restakers quorum would still secure the network, preserving liveness and reducing the impact on security.

The freedom to create Multi-Token Quorums is another example of how Eigenlayer increases programmability in the Web3 stack.

What is being built on top of Eigenlayer?

Eigenlayer can enable the creation of a vast array of use cases. It can be leveraged to build new blockchains, middleware layers, trusted execution environments, and virtually any other PoS AVS. These include:

MEV (Maximal Extractable Value) management protocols

Modular data availability layers

Decentralized oracle networks

Decentralized sequencers for layer-2 rollup blockchains

Cross-chain bridging protocols

New layer-1 blockchains with novel consensus mechanisms

Decentralized storage networks

Decentralized cloud networks

Low-latency settlement chains

So far, only one project has been made public, called EigenDA. EigenDA is a Data Availability layer for rollup chains, like Celestia, that will be secured by ETH re-stakers.

EigenDA is a prudent choice as the first project built on Eigenlayer, as the market for Data Availability is expanding and is expected to continue growing with the adoption of rollup technologies.

Conclusion

While Eigenlayer's marketplace for decentralized trust may be a challenging puzzle to solve, its potential cannot be overlooked. By rerouting trust, EigenLayer seeks to improve the development and scaling of Ethereum by internalizing modularity and accelerating security with permissionless innovation. Moreover, EigenLayer's innovative approach shows how it could contribute towards deleveraging ETH's security by amplifying the cost of attacking its weakest link while driving up demand for staking ETH, leading to higher yields.

Overall, the intricacy and originality of this concept have understandably generated skepticism within the blockchain space. Therefore, it is unlikely that a significant ecosystem will emerge around Eigenlayer in the immediate future. However, this is a natural progression as technology needs to mature, and developers must grasp the concept of re-staking.

While it is challenging to predict precisely how this will play out, one thing is certain: the potential of EigenLayer and its ability to transform the entire space is significant. Thus, we at Efiko remain committed to closely monitoring and reporting on the latest developments.

All the images featured in this article are credited to the EigenLayer whitepaper.

About us

Efiko is a professional service provider that offers a unique blend of management consultancy, technical and market knowledge, and expertise in the Web3 space. We help industry projects and ambitious start-ups navigate web3 across the full journey, including strategic planning, design, technology implementation, and operational delivery.

Follow us on Linkedin and Twitter.

Disclaimer

2023 © Efiko. All Rights Reserved. Efiko and related logos are trademarks of Efiko.This report (the Report) has been prepared for information purposes only. The views and opinions expressed in the Report are those of the author(s) and do not necessarily reflect the views of Efiko and summarize information and articles with respect to cryptocurrencies or related topics.

This Report is for informational purposes only and is only intended for sophisticated investors, and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Efiko. No representation or warranty is made, expressed or implied, with respect to the accuracy or completeness of the information or to the future performance of any digital asset, financial instrument, or other market or economic measure.

The information is believed to be current as of the date indicated and may not be updated or otherwise revised to reflect information that subsequently became available or a change in circumstances after the date of publication. Efiko, its affiliates, and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available.

Certain statements in the Report provide predictions, and there is no guarantee that such predictions are currently accurate or will ultimately be realized. Any forecasts, opinions, estimates, and projections contained in the Report are provided for illustrative purposes only. Such forecasts, opinions, estimates, and projections involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by such forecasts, opinions, estimates, and projections. No responsibility or liability is or will be accepted in respect of, such forecasts, opinions, estimates, and projections or their achievement or reasonableness.

Prior results that are presented in the Report are not guaranteed and prior results do not guarantee future performance. In all cases, recipients should conduct their own investigation and analysis of the data in this Report. The information contained in the Report has not been approved by the Financial Conduct Authority (AFM) or other related authorities. Recipients should consult their advisors before making any investment decision.

Efiko may have financial interests in, or relationships with, some of the assets, entities and/or publications discussed or otherwise referenced in the materials. Certain links that may be provided in this Report are provided for convenience and do not imply Efiko endorsement, or approval of any third-party websites or their content. Any use, review, retransmission, distribution, or reproduction of this Report, in whole or in part, is strictly prohibited in any form without the express written approval of Efiko.

Subscribe to our newsletter and never skip a beat

Get updates on our latest research and important news